closed end loan definition

A closed-end mortgage is sometimes referred to as a closed mortgage. A closed-end loan is a loan such as an auto loan with fixed terms and where the money is lent all at once and paid back by a particular date.

Understanding Finance Charges For Closed End Credit

A closed-end mortgage is otherwise called a closed mortgage this type of mortgage restricts a mortgagor from refinancing renegotiating or seeking an additional loan without paying a breakage fee to the lender.

:max_bytes(150000):strip_icc()/GettyImages-1226911217-72cfba72d793417dae710d72baa38ca6.jpg)

. A closed-end fund or CEF is an investment company that is managed by an investment firm. Specifically the borrower cannot change the number or amount of installments the maturity date and the credit terms. This is different from open-ended loans such as certain types of home equity loans or credit cards where you can borrow repeatedly up to the specified limit and can borrow more as you repay the principal amount.

DEFINITION A closed-end home equity loan lets a homeowner borrow against home equity or the difference between a homes market value and mortgage balance. With closed end credit you agree to a monthly payment that youll make until the end of the loan term. Official interpretation of 2 d Closed-end Mortgage Loan Show.

Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. Most often the term closed-end credit is used synonymously as installment loans. A closed end home equity loan is secured by your home as collateral.

Limitations may include prepayment penalties or forbidding borrowers from using home equity. A closed-end mortgage also known simply as a closed mortgage is one of the more restrictive home loans you can get. Further if you have chosen a loan with a variable rate you should be aware that your monthly payments will rise when interest rates rise.

An example of a closed-end loan is a mortgage loan. Most loans are a type of closed-end credit. Closed-end credit is a type of loan that you only take out once such as an installment loan.

With this type of loan you cant. A closed-end loan is for a fixed amount of money and once the loan is repaid the loan is completed. While a closed-in mortgage may not seem like a great move for anyone purchasing a home there are mortgage holders that will offer these types of financing with very competitive rates.

Closed-end funds raise a certain amount of money through an initial public. If the borrower does negotiate a modification of the loan the borrower will be subject to penalties as determined by the lender. Installment loan Closed-end loans which include installment and student loans and automobile leases are generally charged off in full no later than when the loan becomes 20 days past due.

Closed-end fund definition. D Closed-end mortgage loan means an extension of credit that is secured by a lien on a dwelling and that is not an open-end line of credit under paragraph o of this section. A closed-end loan is a loan such as an auto loan with fixed terms and where the money is lent all at once and paid back by a particular date.

In banking a bond secured by a mortgage in which the mortgage may not be paid off before maturity and the property in question may not be used as collateral on any other transaction without the bondholders permission. A closed-end loan is a loan given with a specified date that the debtor must repay the entire loan and interest. It means you wont be able to increase the principal amount or borrow any further at any point during the loan term after the disbursement of funds.

Since the lender is relying on these monthly interest payments your loan term may include prepayment penalties. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period. A closed-end mortgage places several restrictions on the borrower in exchange for a lower interest rate.

A closed-end loan is also known as an installment loan by traditional lenders. Auto loans and boat loans are common examples of closed-end loans. Definition and Examples of a Closed-End Home Equity Loan.

These loans are normally disbursed all at once in order for the debtor to buy or achieve a specific thing and often the creditor gains rights to possess the item if the debtor fails to repay the loan. With a closed-end loan a borrower typically gets a lump sum. After you repay your balance you cant use the credit or loan again.

Procurement of a closed-end credit is a good indicator of the borrowers. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date. Payments on a Closed-End Loan.

Closed-end credit is a type of loan or credit agreement signed between a lender and a borrower that includes details about the stipulated amount borrowed interest rates and charges applicable and monthly installments payable depending on the borrowers credit rating. Taking out a second mortgage without receiving permission from a lender is not admissible in a closed-end mortgage. This mortgage type is currently available in both fixed and variable interest rate models.

The funds you apply for are disbursed all at once. One of many loan products offered by lenders a closed-end loan is a loan that is paid to the borrower in a lump sum of money to be re-paid in full within a specified time frame. And if you are 60 to 90 days late in making payments your lender may be forced to foreclose on your house.

In real estate a mortgage in which the principal amount may not be increased. This payment includes interest and principal which slowly decreases your loan balance until its satisfied. Youll have to apply for new credit if you need to borrow again.

By contrast open-end loans such as credit cards can have the amount owed go up and down as the borrower takes money against a credit line. That money plus interest must be repaid by a specific date. Installment loan Closed-end loans which include installment and student loans and automobile leases are generally charged off in full no later than when the loan becomes 20 days past due.

Understanding Mortgage Closing Costs Lendingtree

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Open Vs Closed End Leases What To Know Credit Karma

Loan Vs Mortgage Difference And Comparison Diffen

What Are Closed End Funds Forbes Advisor

:max_bytes(150000):strip_icc()/GettyImages-1226911217-72cfba72d793417dae710d72baa38ca6.jpg)

Closed End Line Of Credit Definition

Consumer Loan Types And Categories Of Consumer Loan With Example

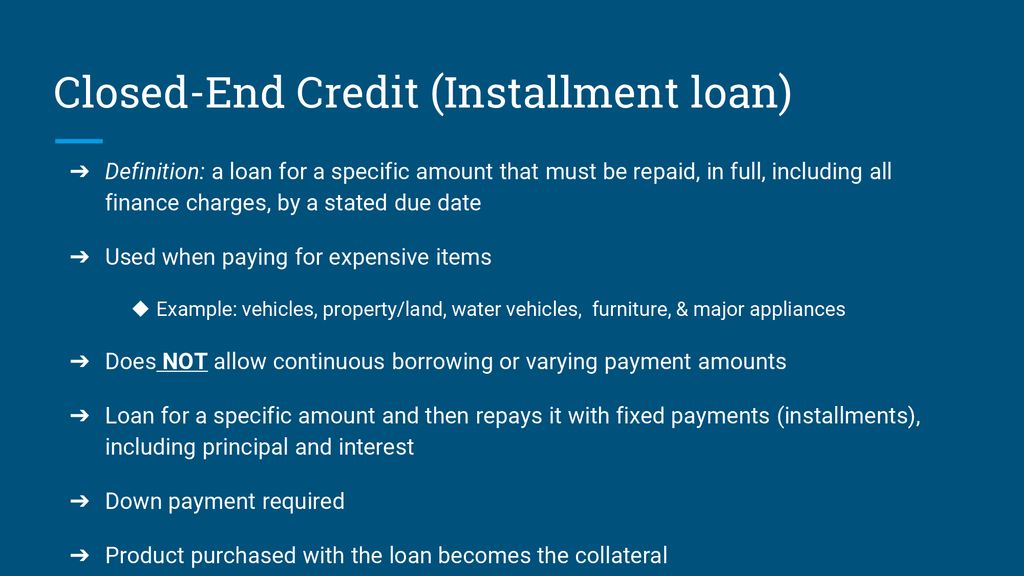

Lesson 16 2 Types Sources Of Credit Ppt Download

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Home Equity Loans Vs Home Equity Lines Of Credit Mid Hudson Valley Federal Credit Union

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

![]()

What Types Of Loans Are There Student Loan Hero

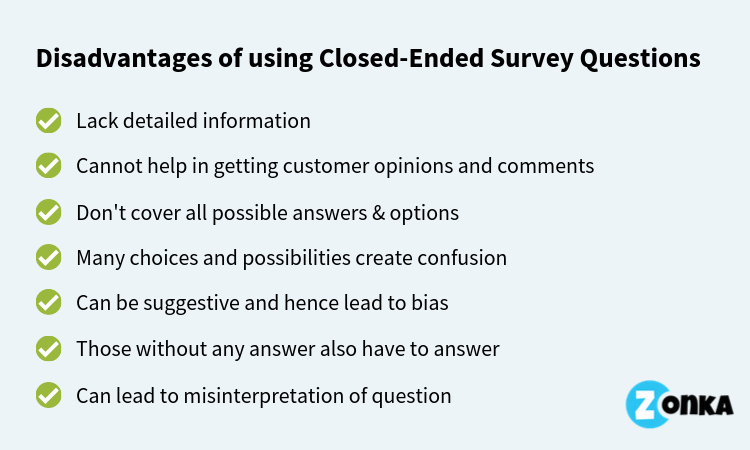

Advantages Disadvantages Of Closed Ended Questions In Feedback Forms

What Is A Closed End Fund And Should You Invest In One Nerdwallet

/155571944-5bfc2b9646e0fb005144dd3f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

:max_bytes(150000):strip_icc()/GettyImages-660495523-57c1f9a05f9b5855e57bfa83.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)